The infrastructure behind

‘Yes, we can prove that.’

Fragmented governance tools create audit gaps and operational risk. EQS gives you verifiable control across risk management, compliance, privacy, and ESG from a single, accountable provider.

Trusted by 14,000+ customers around the globe

Key benefits of EQS software platforms

Single system.

Multiple mandates.

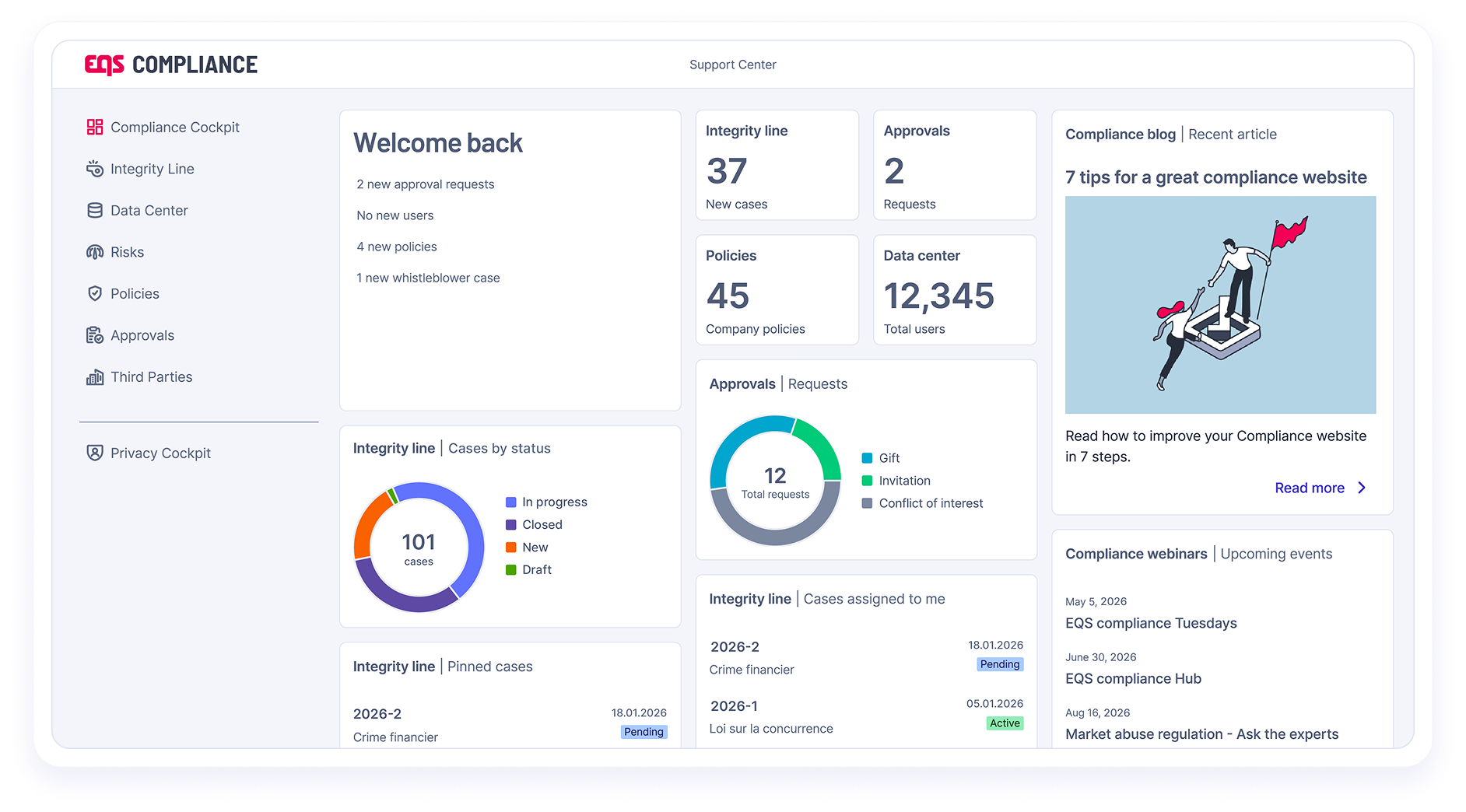

Compliance doesn’t end at the hotline. You need secure intake, policy distribution, conflict disclosures, and third-party due diligence all working together. EQS handles the complete workflow on one platform.

Compliance Cockpit modules

Whistleblowing & Case Management Module

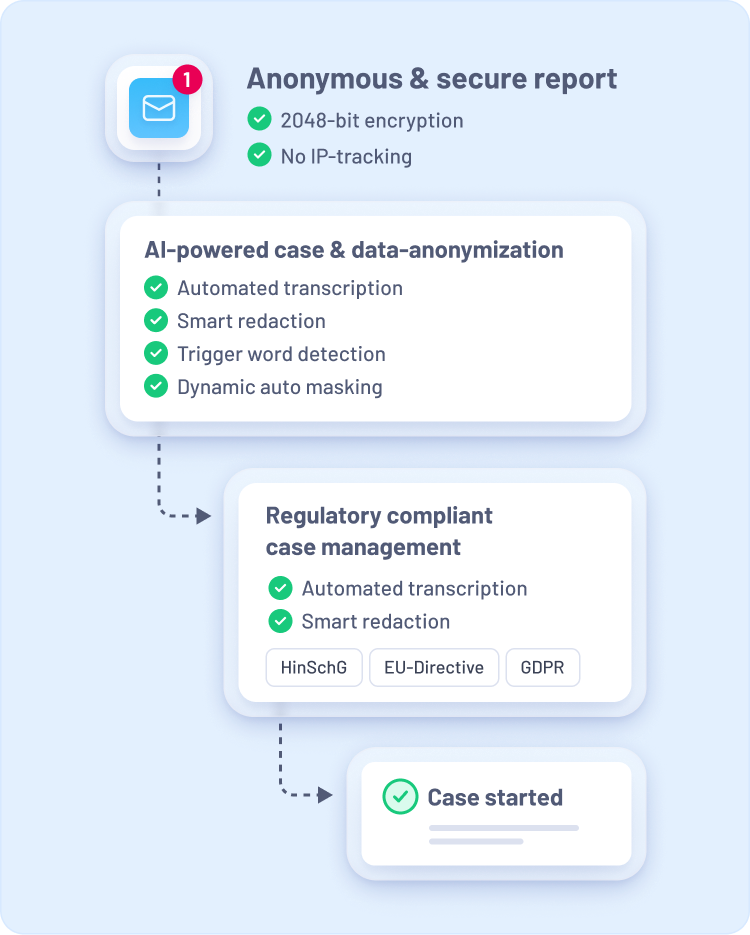

Anonymous reporting that protects anonymity

Integrity Line transforms regulatory necessity into a competitive advantage with an intuitive and superior case management experience. It goes beyond static compliance, delivering a user-friendly interface and stellar configurability that modern compliance teams demand.

You gain automated routing, self-configurable, multi-stage investigation workflows, and end-to-end encryption that keep investigations organized from first report to final follow-up. Reporters stay protected. Internal investigations stay in control. Every investigation leaves a clean, defensible record.

Third-Party Risk Management Module

Due diligence that scales with your vendor network

Third Parties is the centralized TPRM platform that brings structure and oversight to your entire third-party process. It allows you to build risk profiles, initiate dynamic due diligence and automatically track status across your global vendor network.

TP ensures that all vendors automatically attest to your mandatory code of conduct and policy commitments, providing defensible compliance and confidence over every external relationship – all within a single, auditable trail.

Policy & procedure Management Module

Ensure policy acknowledgement and verifiable distribution

Policies ensures the right people get the right documents and legally attest receipt. It goes beyond simple distribution: the system allows you to launch targeted campaigns that deliver policies, mandatory training, and critical updates directly to relevant employee groups or external vendors.

With scheduled reminders and real-time reporting, you get a clear, audit-ready record that proves compliance and builds a culture of shared awareness.

DISCLOSURE management Module

Digitize and trace critical compliance approvals

Approvals centralizes conflicts of interest, outside roles, gifts, hospitality, and other sensitive declarations in one compliant, automated workflow. Every request is routed precisely according to your rules, every action is logged, and every decision is audit-ready. This centralization does away with manual chasing, ensures all critical decisions automatically feed compliance oversight, and keeps leadership firmly in control.

Insights Module

Unify compliance data into dashboards

Insights pulls data from across your compliance modules – from case status to policy acceptance – and presents it in clear, unified dashboards within the platform, while also enabling easy extraction for deeper analysis with the tools of your choice. This gives leadership the unified view required to track case resolution status, monitor policy compliance, and prove program effectiveness to the board.

Buy the specialized tool you need.

Get the provider you deserve.

The strategic cost of fragmented toolsets always outweighs the cost of the single-provider model.

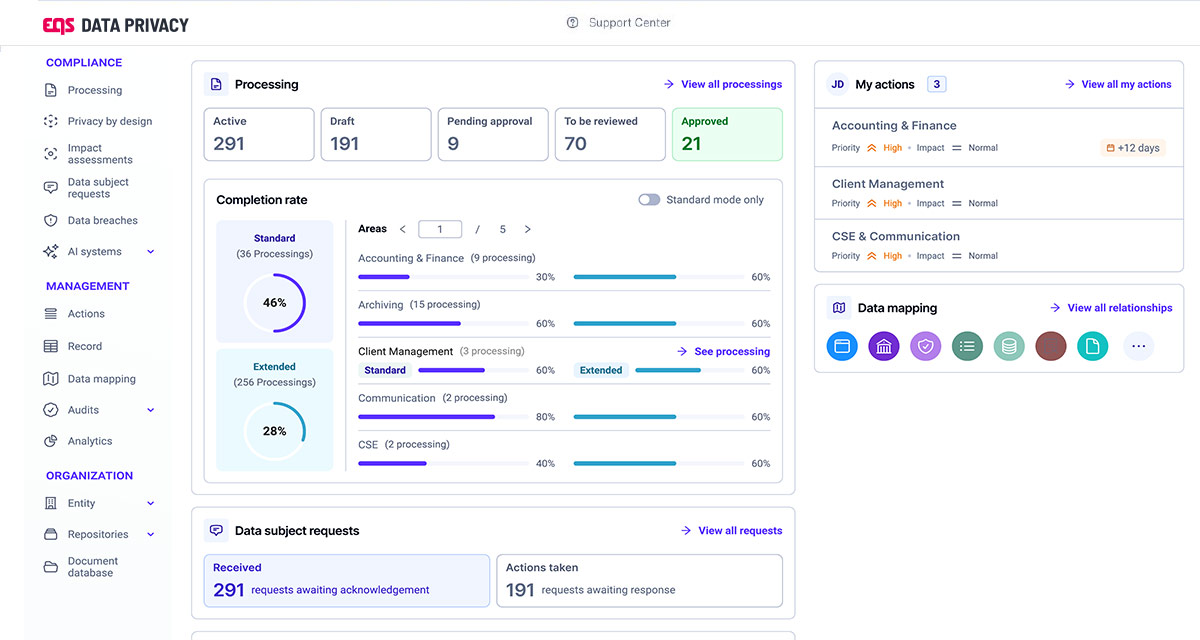

Manage all data processing and meet the emerging AI Act mandate

Your data protection posture is defined by auditable records, not good intentions. EQS Privacy Cockpit centralizes your record of processing activities (RoPA), manages Data Protection Impact Assessments (DPIAs), and handles Data Subject Requests (DSR) fulfillment on one platform.

The system includes tools to document and assess your AI systems, ensuring compliance with the stringent requirements of GDPR and the emerging EU AI Act.

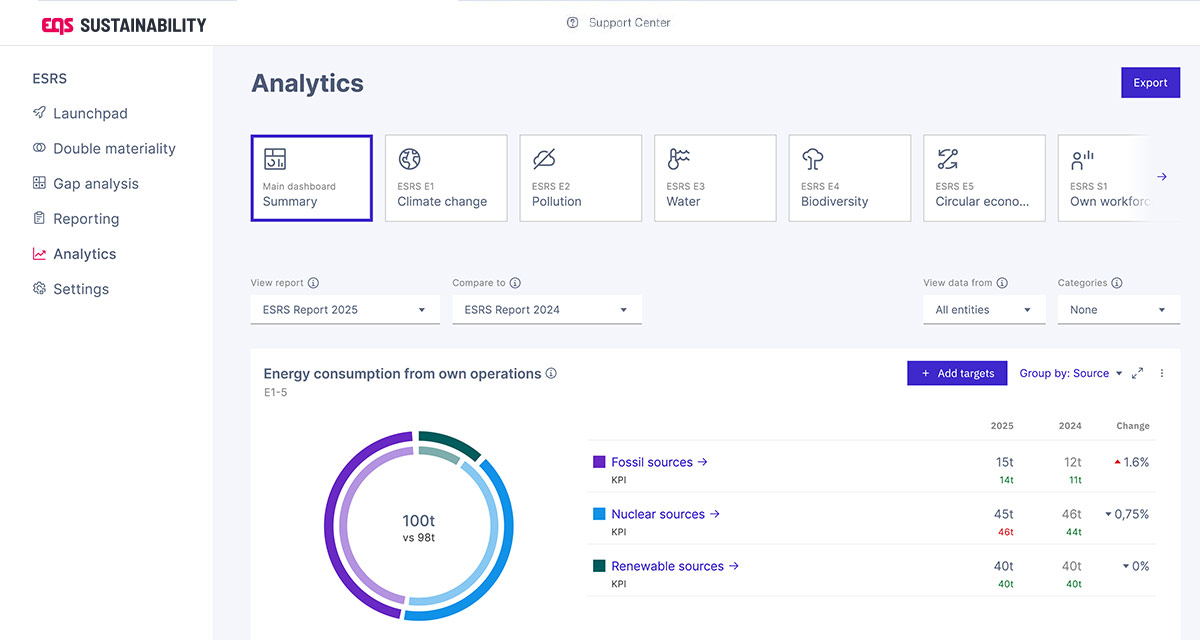

Govern the end-to-end ESG and CSRD disclosure mandate

CSRD isn’t a reporting exercise. It’s a data management problem. EQS Sustainability Cockpit handles Double Materiality assessments, manages the collection of non-financial data, and structures audit-ready reports compliant with CSRD/ESRS, GRI and other global frameworks.

Your investors care. Your auditors will check. Your system needs to hold up to both.

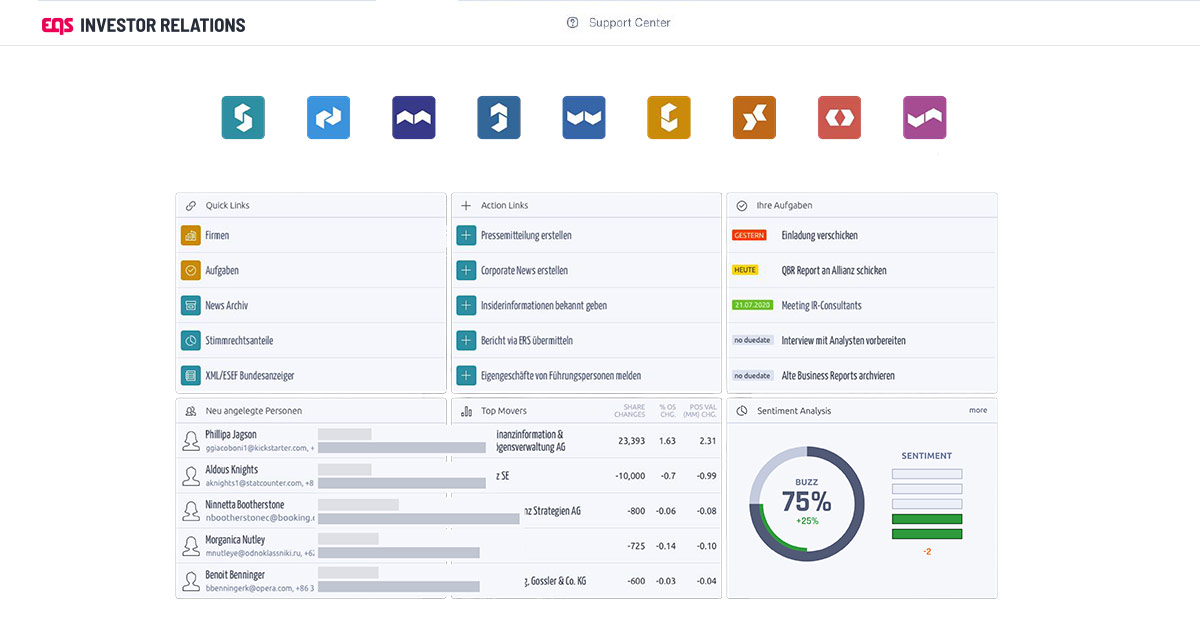

IR requires certification. Not simple distribution.

Investor Relations isn’t marketing. It’s regulated disclosure with legal consequences. The IR Cockpit handles certified regulatory news (Ad-hoc and MAR compliance), virtual event management, mandatory reporting, and digital investor materials.

Using uncertified tools for mandatory disclosure is a(nother) liability you don’t need.

Customer testimonials

One Provider.

Four Core Risk Domains.

Integration overhead, security duplication, and vendor coordination compound fast. Consolidation is structurally cheaper and legally safer.

You’re likely managing compliance, privacy, ESG, and IR across four vendors.

Four contracts. Four security reviews. Four integrations. Four failure points.

EQS covers all four domains. Start with one module. Scale when regulation demands it or complexity outgrows your control. The vendor relationship stays stable. Infrastructure stays connected.

Enjoy all these benefits and much more

INNOVATION

Tech that keeps pace with regulations

AI-powered case management speeds up investigation closure

Automated routing of disclosures

Interactive data maps for visibility and traceability

SERVICE

Partnership built for long-term governance

Dedicated customer success manager for strategic support

24/7 technical support for global, cross-border operations

Expert guidance when regulations change (and they will)

TRUST

Infrastructure built for sensitive data

SOC 2 certification for the highest security standard

GDPR compliance built into every module

European server hosting for data sovereignty

Building your governance

infrastructure

We don’t believe in forcing you into a full suite before you’re ready.

Our team helps you identify what you actually need and where regulatory pressure is highest. Start with one tool. And scale as and when it makes sense.

Step 1

Identify your priority

Tell us where risk is most acute:

Step 2

Talk to someone who understands regulations

Our sales team has regulatory expertise, not just product knowledge. We’ll scope what you need – not what we want to sell.

Step 3

Make an informed decision

You’ll get direct access to:

- a dedicated contact

- technical support to verify system fit

- all necessary documentation to evaluate the platform properly

About EQS

At EQS, our work is driven by a single question every day: How can we help companies navigate rising complexities better while staying true to their values?

Since 2000, we’ve supported organizations in building trust – turning compliance, data privacy and sustainability challenges into meaningful opportunities.

600+ Employees

14 Locations worldwide

14,000+ customers

80+ Operating countries

Our latest resources

Check out our latest blogs, guides, and resources covering Compliance, Data Privacy, and Sustainability Management.