Trusted by 10,000+ organizations globally

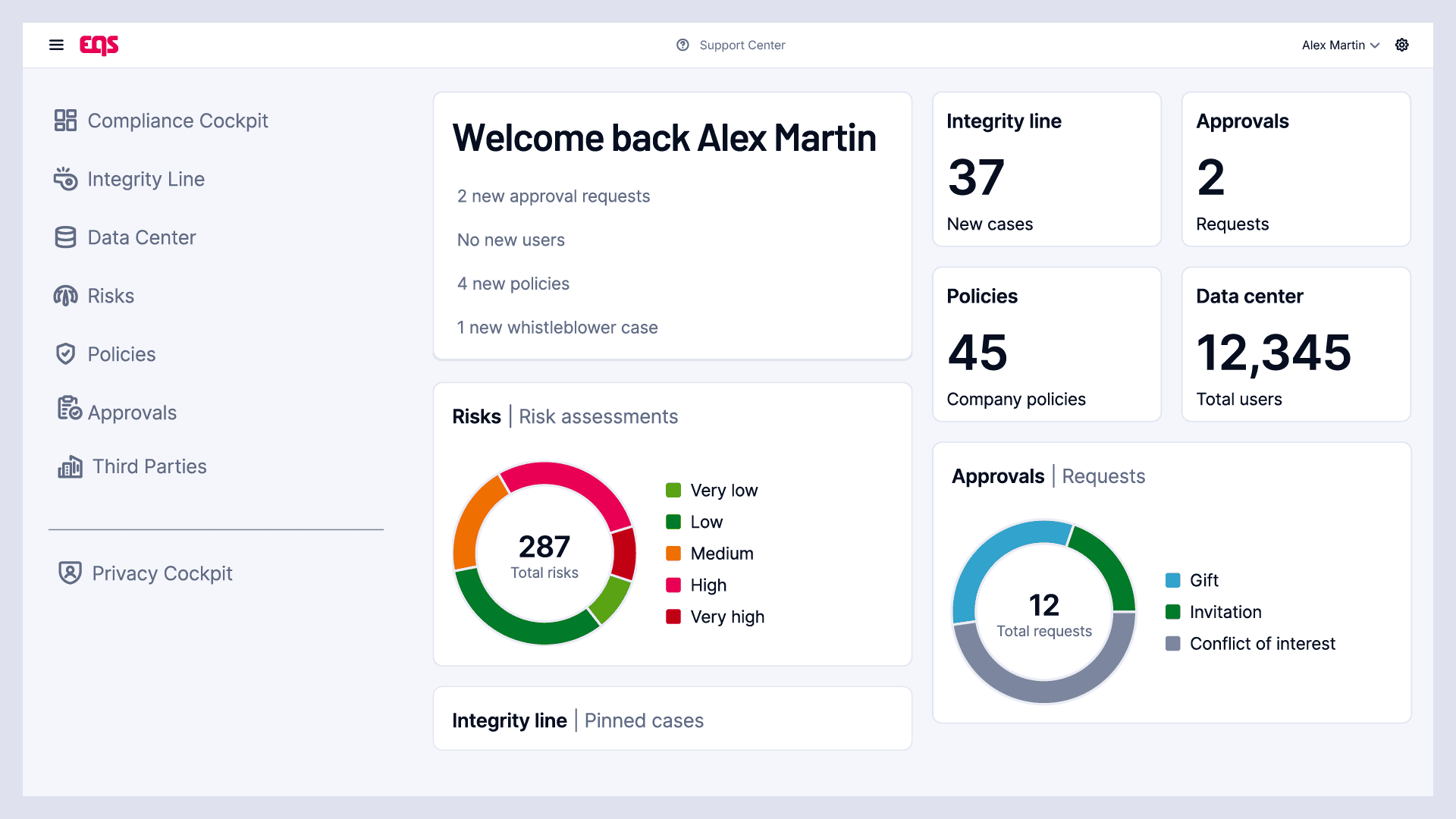

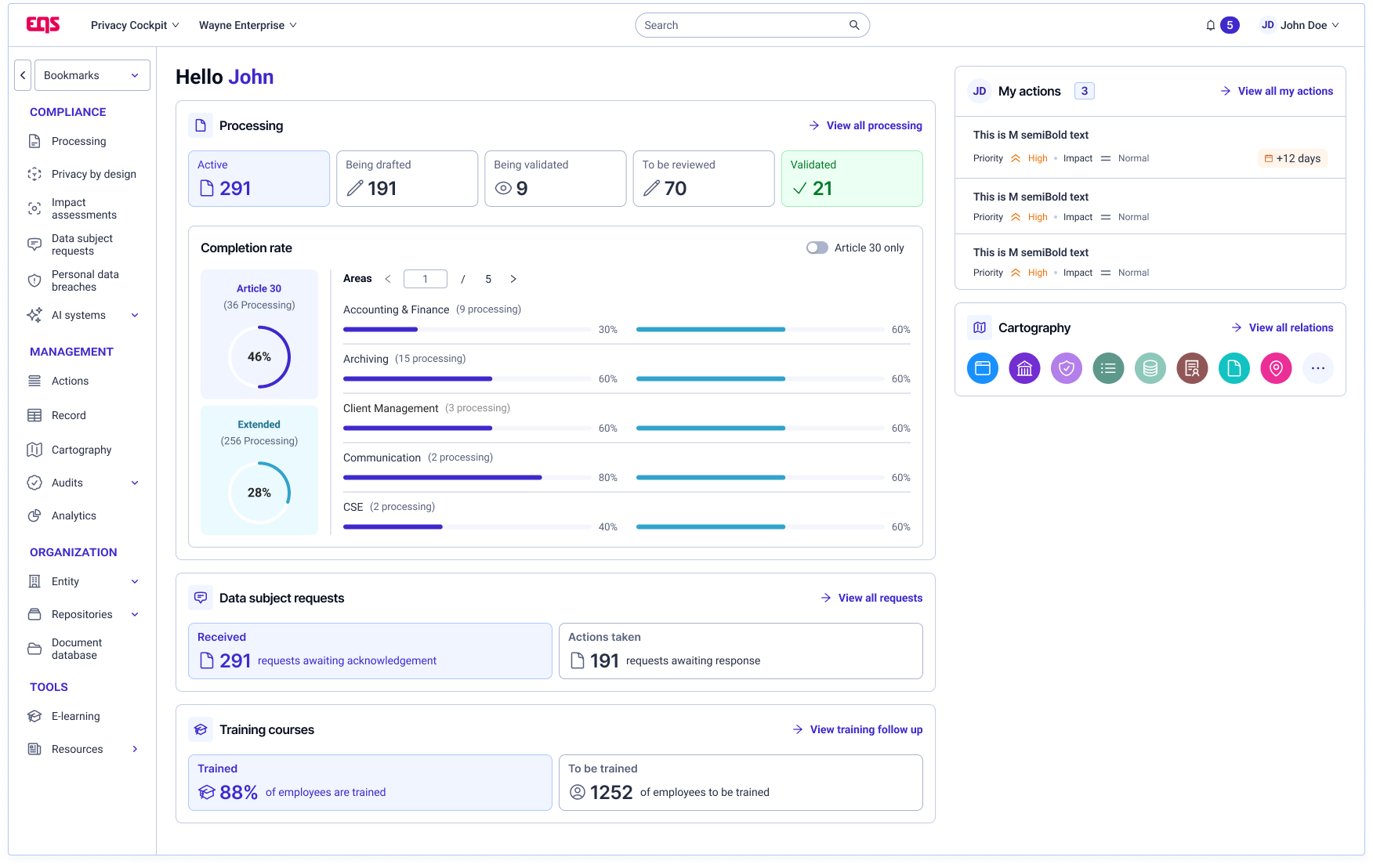

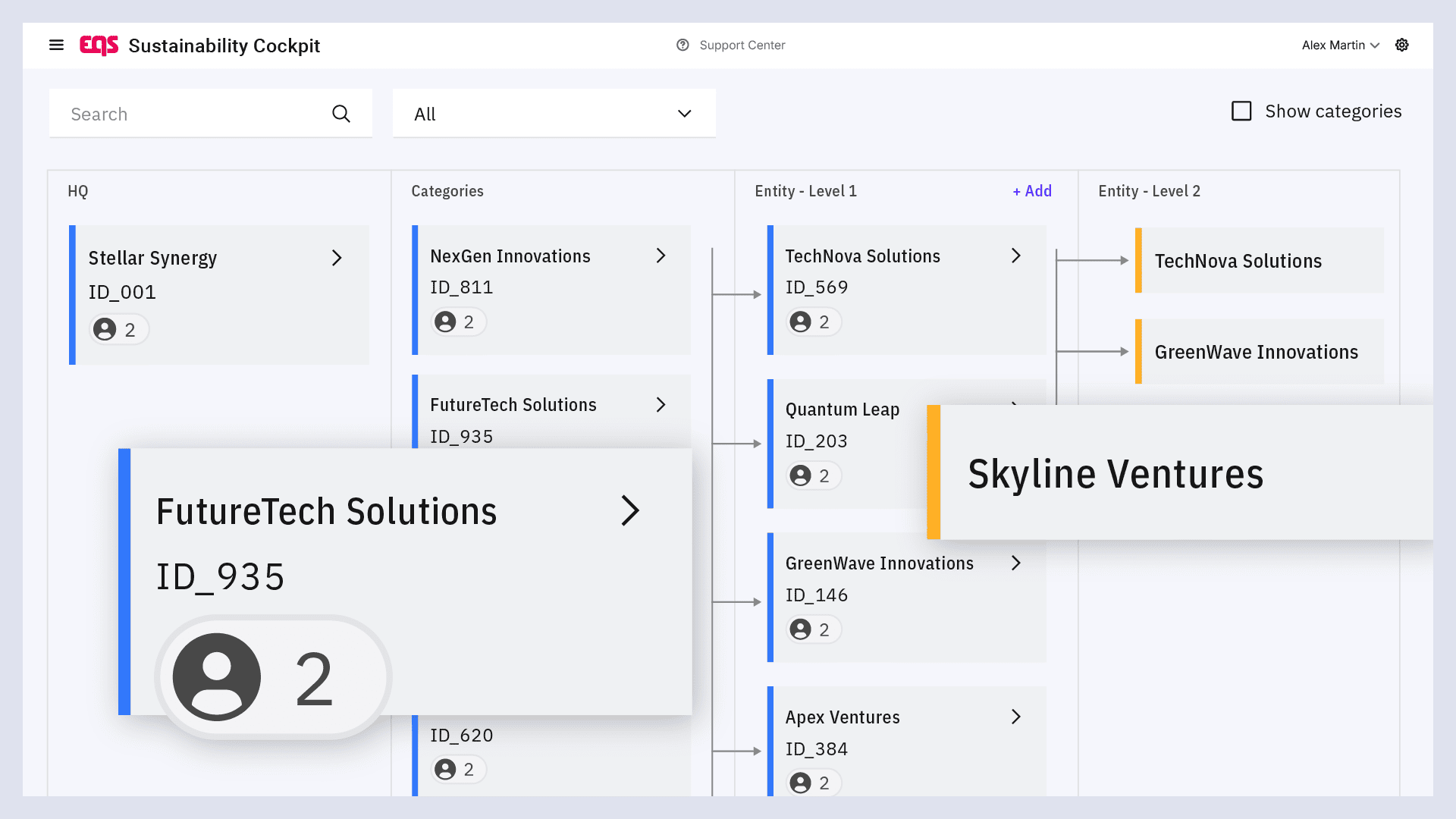

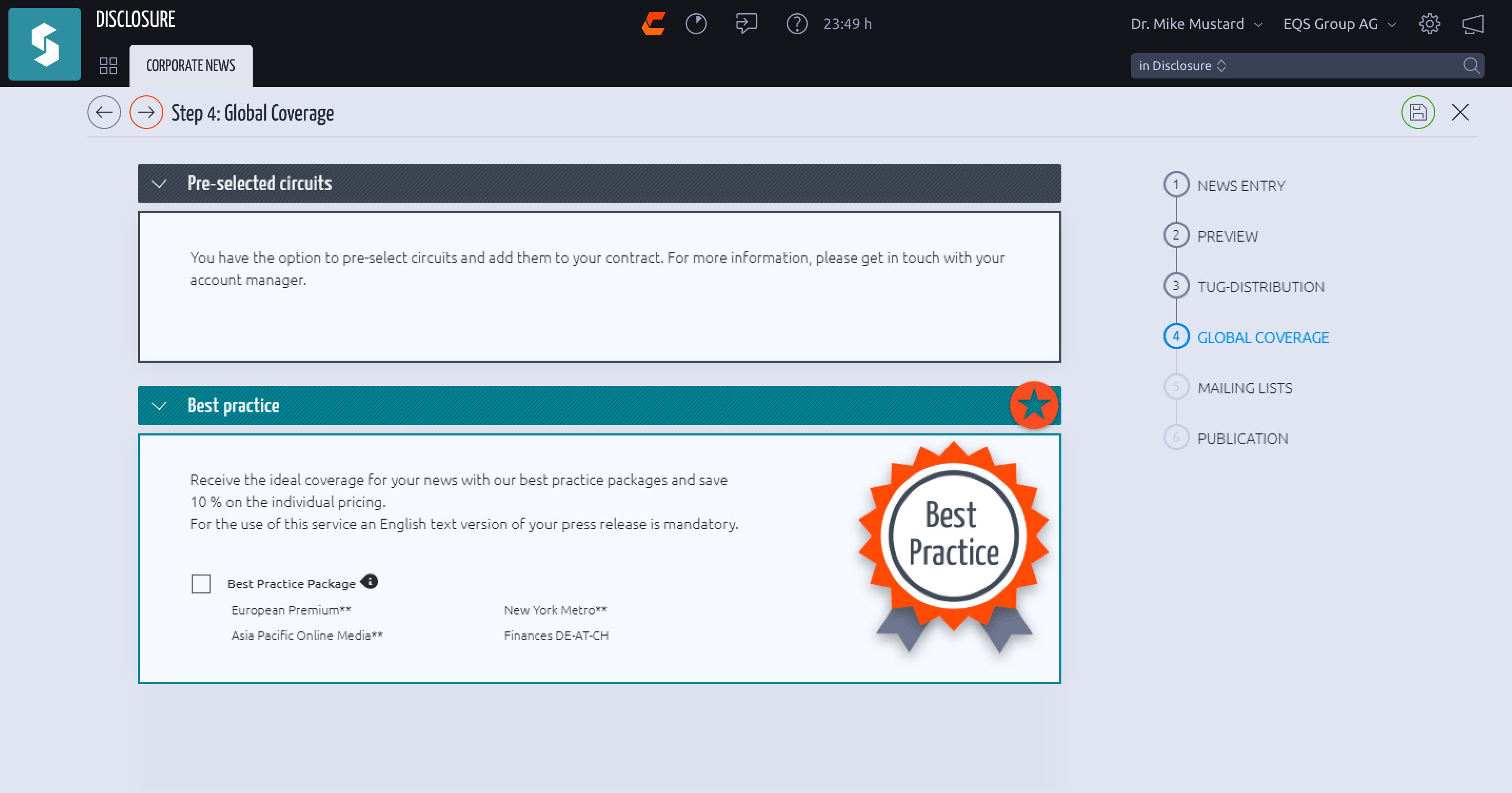

Your foundation for responsible business leadership

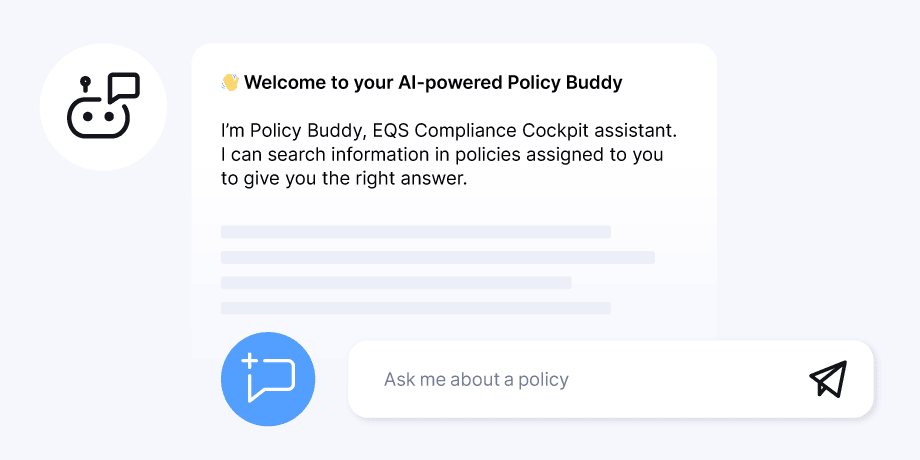

We combine effective compliance management, advanced data protection, and comprehensive sustainability reporting to help organizations such as yours build trust and drive positive impact.

A unified approach to trust & transparency

What our customers say

We wanted to set up a system that would inspire confidence among employees and be user-friendly for reporting. At the same our compliance team needed a professional and efficient case management solution.

We evaluated several providers and we found out that EQS Group provided the simplest and most straightforward product, thus the best solution for our requirements.

Kristina Schmieg, Senior Manager Compliance

PUMA SE

Why customers love us

Find out why business leaders choose EQS

Who we are

At EQS, our work is driven by a single question every day: How can we help companies navigate rising complexities better while staying true to their values? Since 2000, we’ve supported organizations in building trust – turning compliance, investor relations and sustainability challenges into opportunities.

Resources to learn more about EQS

Make compliance work for you

Your time is valuable. See how leading organizations use EQS Group to turn compliance and sustainability challenges into business advantages. Let’s talk.