LEI – The mandatory financial identifier

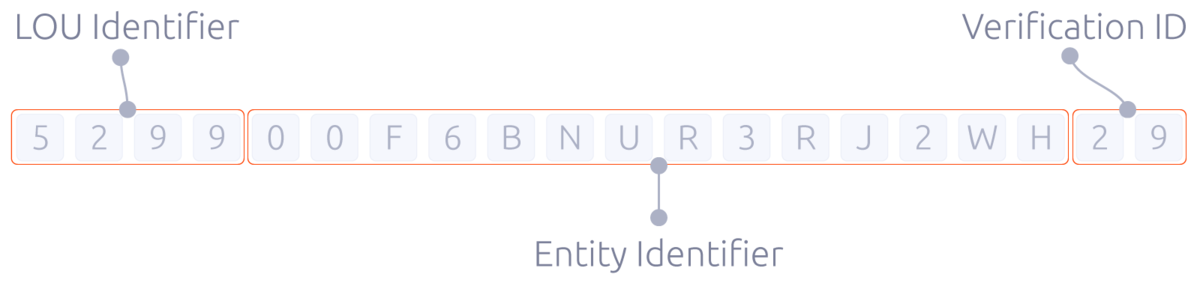

The Legal Entity Identifier (LEI) is a globally-standardized and unique identifier for financial market participants. The financial crisis demonstrated the difficulty of identifying complex company networks, financial constructions, and counterparties for banks and regulators. The global LEI system counteracts this. An LEI allows clear identification of each contract partner and aids in disclosure to supervisory authorities. The LEI is valid worldwide.

Who needs an LEI?

Companies currently require an LEI to:

- participate in derivatives trading.

- register financial derivatives to a transactions register, which is mandatory since the February 12, 2014 roll-out of Article 9 of EMIR (the European Market Infrastructure Regulation).

- complete direct reporting by national register (e.g. voting rights declarations).

- fulfill mandatory disclosure requirements according to Article 26 of the European Financial Market Regulations (MiFIR, MiFID II).

Key groups that are affected by LEI legislation are: banks, credit intuitions, insurance companies, securities service companies and investment funds. Corporations, associations, commercial companies, joint ventures and registered merchants may also be affected.

In view of the growing regulation of financial markets, it is anticipated that the use of LEIs will be adopted by many authorities and institutions worldwide. Subsequently, many non-financial counterparties that may be involved in derivative contracts will also be required to obtain and use LEIs. Individuals and legally-dependent companies are currently not required to use an LEI.

Get your LEI easily with LEI Manager

You must apply for an LEI with an official LEI issuing authority. Less than fifty issuing authorities exist worldwide, and EQS Group is one of them. For an easy, quick and reasonable application process, we developed our LEI Manager.

When applying for your LEI using the EQS LEI Manager you will receive:

- Lowest LEI prices within Europe

- LEI application processing within 24 hours

- 24/7 support hotline

- Highest security standards

- Local expertise from our worldwide offices

- Easy payment via invoice or credit card

Quick, easy and cost efficient

With EQS LEI Manager, the initial application for an LEI is only €49. We ensure LEI application processing within 24 hours

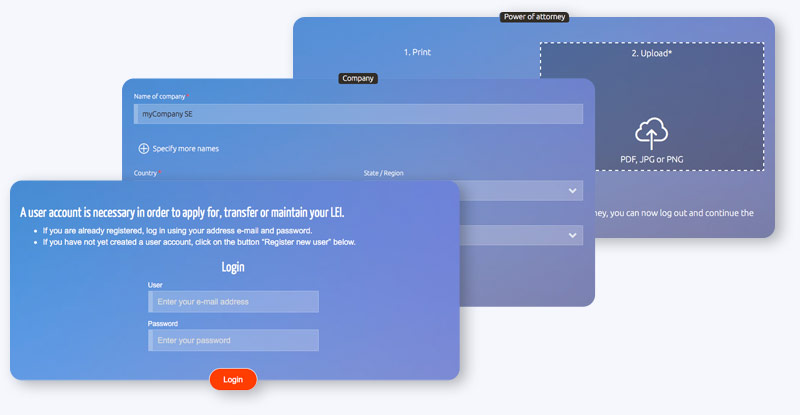

The application process is simple:

- Register on www.lei-manager.com

- Enter your company information

- Upload a register excerpt and a power of attorney

- Get your LEI within 24 hours